Taxes and Real Estate

Nothing contained in this article shall be construed to be tax advice, which should only be obtained from a licensed professional.

Tax reform has certainly been a hot topic recently! Regard-less of whether you agree, or disagree, with the fundamental concepts of the Tax Cuts and Jobs Act (H.R. 1) (TCJA), it is now the law of the land. We will offer a general overview of the TCJA, as it relates to investment property.

In a recent article published in a forum sponsored by the National Association of Residential Property Managers (NARPM), Daniel Bornstein summarized the impact, below you will find his analysis.

The National Apartment Association, in partnership with the National Multifamily Housing Council, has applauded the tax overhaul, touting it as a smart tax policy. One of the most adorning centerpieces of the TCJA is the protection of flow-through entities. Not surprising, because three quarters of apartment properties operate as flow-through entities, including residential landlords who own their rental property as sole proprietors, real estate investment trusts, LLCs, S corporations or partnerships.

Under these tax provisions, businesses avoid the double taxation of paying corporate and individual taxes. Instead, taxes are applied solely at the individual level. Unlike owner-occupants, rental property owners can write off expenses like mortgages, repair and management costs. Since these costs of doing business are deducted from the income the property produces, investors are only taxed on that income, so by reducing it, the investment acts as a tax shelter.

The TCJA, however, creates a new tax deduction for individuals who realize income through pass-through entities under Section 199A, also known as the Qualified Business Income De-duction, which arose from the Tax Cuts & Jobs Act of 2017. If rental activity qualifies as a business for tax purposes, as most do, owners may be eligible to deduct an amount equal to 20% of their net rental in-come. This is in addition to all other rental-related deductions. If landlords qualify, they are effectively taxed on only 80% of rental income.

There are many rules and limitations, of course, and as with any major revisions to the tax code, there will be modifications and interpretations which will change how this creature can be used.

The TCJA also retained the ability of an investor to perform a like-kind exchange utilizing Section 1031 of the current tax code, thus deferring gains and depreciation recapture.

Carried interest was also retained, although a 3-year holding period was put in place. This will allow capital gains treatment, thus lowering the tax burden.

We would encourage you to seek out additional information and speak with your licensed tax preparer prior to making any decisions that will impact your finances.

Cold Weather!

The weather is something that is out of all our control, but not something that cannot be reasonably planned for. The recent extreme cold that hit the East Coast had a significant negative impact on our area. According to Steve Drew, Water Resources Director for the City of Greensboro, the city has had 140 broken pipes since Christmas!

Unlike the City of Greensboro, pipes in rental properties can be isolated and properly protected. The pipes that supply our water are in the ground and cannot easily be protected.

Water heaters are one particular area of concern during extreme cold, as many are outside the thermal envelope of the home. By being out-side the thermal envelope they are more susceptible to freezing, thus causing significant damage to both the home and surrounding area.

P-traps are another area of concern during extreme cold. These are typically located beneath a drain and stay filled with water to prevent sewer fumes from infiltrating the home, which is certainly a positive. However, they will freeze in extreme cold. Once they freeze, they will expand and potentially break the joint that holds them together. Upon thawing, there will be a leak which could cause significant damage.

The benefits of a professional winterization extend far past peace of mind. The potential impact of a broken pipe could be financial ruin. Unfortunate-ly, we had a situation many years ago where the owner of an investment property failed to have a winterization performed ; subsequently suffering a devastating $50,000+ loss. This was with the heat on! The attic was not heated, as is customary.

The water heater was located in the attic of a 3-story home and burst during a period of extreme cold. Water, from the water heater, ran all the way down to the basement for a short period until it was discovered, but it was too late to pre-vent significant damage.

With such a significant loss, the insurance company did an investigation and concluded that the owner did not follow proper protocols in taking reasonable precautions to prevent such damage. Claim denied!

It is never possible to prevent all damage to a home, especially a rental home, but proper precautions can limit your liability significantly. Liability reduction is one of our specialties at Birch Management. There are numerous resources that we have available to our clients, including our maintenance manual. For more information on winterizations, visit: http://www.thebirchcompanies.com/winterization.aspx

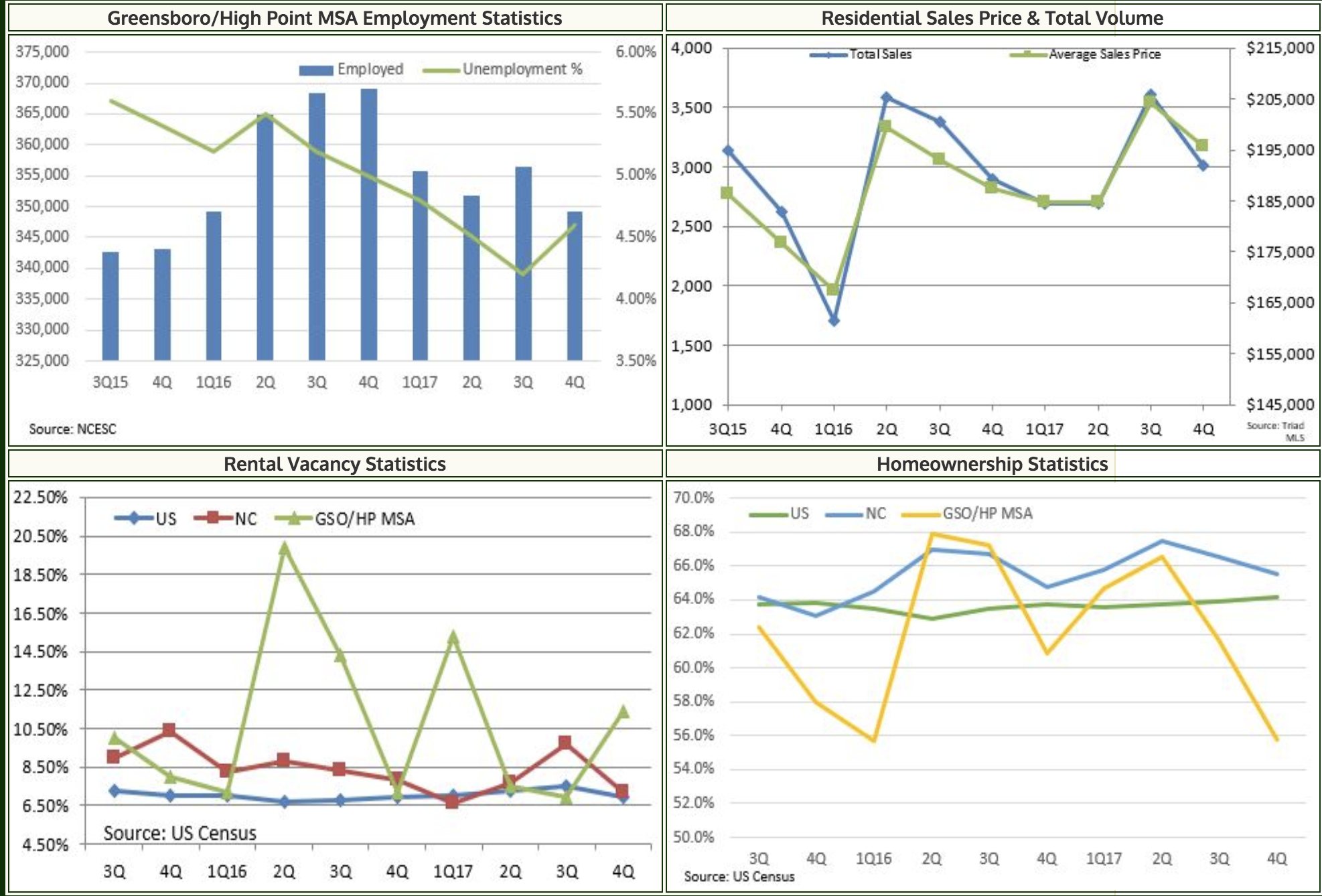

Market Statistics

Service Announcements

Client Services Dedicated E-mail:To reach your dedicated Client Services Team via e-mail, just use the e-mail address client@birchmgmt.com and our entire Client Services team will receive it and respond promptly.

Client Services Direct Dial Number: To reach your dedicated Client Services Team, simply dial 844-5CLIENT (525-4368) to be routed to our entire Client Services Team. If someone is available your call will be answered, if you get our client voicemail please leave a detailed message so we may return your call as soon as possible. Do keep in mind that our Client Services Team is always on the go evaluating the needs of your properties!

Owner Web Login: Our industry leading owner web login on our website is our clients' link to their information. Here is a sample of the information that is available by logging into your secure account on our website:

- Account Balance

- Open Payables

- Open Receivables (has my tenant paid)

- Service Issues

- Posted Invoices- retrieve and store copies of all invoices posted to your account

Operating Schedule: Our regular operating hours are Monday to Thursday 8:30am-5:00pm and Fridays from 8:30am-4:00pm. Our next scheduled office closing will be Monday May 28, 2018.

1099's: All 1099's have been mailed and yearly statements delivered via e-mail. Please visit your portal for more details.

Our Mission

Our mission is to offer personalized and professional service to both our clients and customers by building strong relationships, utilizing the latest technology, implementing effective marketing strategies, following consistent systems all with honesty and integrity throughout every facet of our business.