Sales Tax

On December 29, 2016, we became aware of a sales tax on certain maintenance labor expenses with an effective date of January 1, 2017.

In consultation with our Certified Public Accountant (CPA), maintenance providers, and legal counsel it was determined that most labor on maintenance items is subject to this sales tax.

The North Carolina Association of Realtors Government Affairs Department has deter-mined that taxing rental property maintenance was, not necessarily, the intent of the law. There is also information that a bill will be introduced to carve out this form of maintenance form being subject to sales tax.

Unless there is a modification to the current law, all maintenance labor is lawfully required to incur a sales tax of 6.75% effective January 1, 2017.

Resident Retention

With very few exceptions, vacancy is the largest expense a landlord will incur, it is also a given with every rental property. Every day that goes by without rent being generated, is a day lost that cannot be recovered.

In previous editions of The Birch Quarterly, we have touched on the steps we take to reduce vacancy, now we will touch on resident retention.

To fully understand the impact of retention, you must first understand why people decide to move. The local economic conditions greatly impact retention. Our soft local economy and low mortgage interest rates have not been conducive to retention. This is clearly evident by the lease termination statistics in 2016, which were very similar to those of 2015, when job relocation lead the way. Below is a summary for calendar 2016:

- Bought a house: 25.3%

- Relocation: 22.1%

- Budget: 14.7%

- Neighborhood: 9.5%

- Downsize: 9.5%

- Maintenance*: 3.2%

- Various under 3%: 15.7%

* (All maintenance terminations were at properties where the landlord self-performed)

Even with many more residents buying homes in 2016, than 2015, we were able to achieve a 73.4% renewal rate, down from 82.3% in 2015; however, much higher than the industry average of 55.1% (an all-time high). There are a few key components to the drop in the base renewal rate, including increased Section 8 residents (that program man-dates that all leases revert to month to month after 1 year and cannot be renewed) and many more residents choosing to pay a 10% rental premium to go month to month.

Digging deeper into the data, pulling out those residents who left our market, either through job relocation or buying a home (they left the rental market), our renewal rate paints a different picture. A total of 47.8% of lost residents actually left the local rental market. After adjusting for those residents, we were able to achieve an 86.2% lease renewal rate.

While it would not be prudent to reveal our entire program, the numbers speak for them-selves. One of the most important components of our master resident retention plan is our maintenance operations, followed by our resident communication plan, helping remove two very common complaints. We will be continuing to improve these segments of our business in 2017.

2016 Wrap-Up

While the first month of 2017 is almost behind us, there are still a few 2016 items that we are diligently working to wrap up. One of the biggest beginning of the year challenges is always the completing and filing of all of the government mandated financial forms. The IRS mandates that any company that pays an individual over $600 be supplied a form 1099. We have completed these forms for each of our clients, and they have been mailed out. Additionally, in an effort to assist with your tax return filing we have sent out calendar 2016 financial statements. Keep in mind, that you can login to your secure owner web portal at any time to access all financial re-ports. Many of our clients pro-vide their CPA with online access to speed the process along!

IRS rules also require that any investment property owner who pays more than $600 to either an individual, or company (ie: maintenance vendor) then must supply that payee with a form 1099. As part of our services, we remove that burden from you by supplying the form 1099 to each vendor who performed work on your investment property.

Once the year end tasks are complete, we will shift our focus to our 2017 initiatives. Here is a snapshot of our planned enhancements:

- Continued improvement to our software capabilities throughout the year

- Improved online portal and instructional videos

- Maintenance operations and documentation improvements

- Inspection report and follow-up improvements

- Continued improvement in our property leasing plat-form

There is not an area of our company that we are not looking to roll out improved initiatives. Keep an eye out for future up-dates on these initiatives and many other exciting happenings!

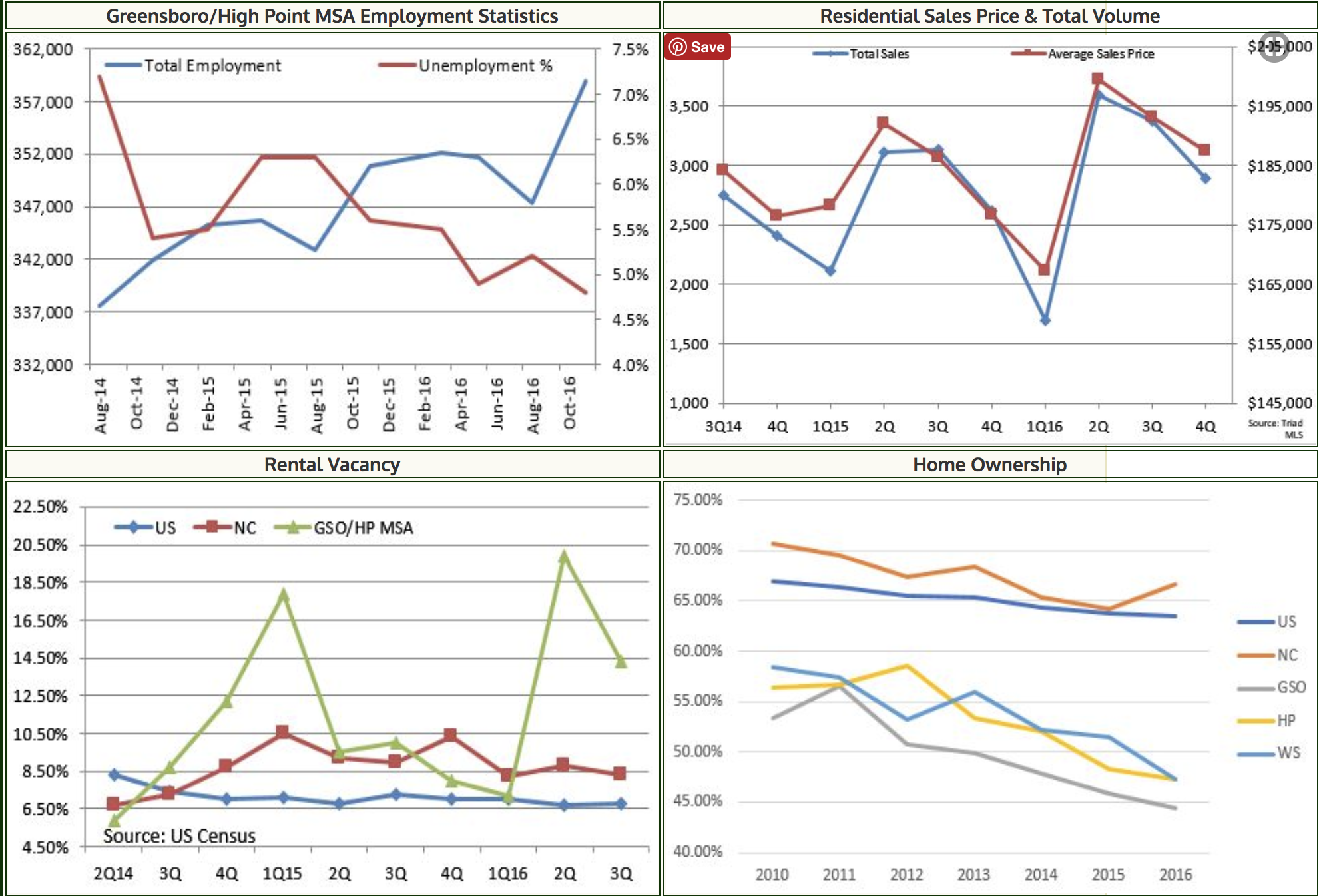

Market Statistics

Service Announcements

1099’s: All 2016 IRS Form 1099’s will be mailed on, or before January 31, 2017. Additionally, yearly financial statements will go out shortly after the 1099 forms are mailed. The forms and statements are also available in your portal on our website.

Toll Free Direct Number: Our clients can now simply dial a toll free number 1-844-5CLIENT (525-4368) to be routed to our entire Client Services Team. If someone is available your call will be answered, if you get our client voicemail please leave a detailed message so we may return your call as soon as possible. Do keep in mind that our Client Services Team is always on the go evaluating the needs of

your properties!

Owner Web Login: Our industry leading owner web login on our website is our clients' link to their information. Here is a sample of the information that is available by logging into your secure account on our website:

- Account Balance

- Open Payables

- Open Receivables (has my tenant paid)

- Service Issues

- Posted Invoices- retrieve and store copies of all invoices posted to your account

Operating Schedule: Our regular operating hours are Monday to Thursday 8:30am-5:00pm and Fridays from 8:30am-4:00pm. Our next scheduled office closing will be Friday April 14, 2017.

Our Mission

Our mission is to offer personalized and professional service to both our clients and customers by building strong relationships, utilizing the latest technology, implementing effective marketing strategies, following consistent systems all with honesty and integrity throughout every facet of our business.